Are you a thrill-seeker, always craving the next adrenaline-pumping adventure? Whether you’re scaling mountains, diving into the depths of the ocean, or exploring remote corners of the world, it’s essential to have a safety net in place. That’s where travel insurance comes in, providing peace of mind and financial protection for your adventurous escapades. But with so many options available, how do you choose the best travel insurance for your unique needs?

This comprehensive guide will equip you with the knowledge to select the perfect travel insurance policy for your next thrilling adventure. We’ll delve into the key features to consider, explore different types of coverage, and provide valuable tips for maximizing your protection. So, buckle up and get ready to conquer your next escapade with confidence, knowing you’re covered every step of the way.

The Importance of Specialized Insurance for Adventure Travel

Adventure travel is all about pushing boundaries and exploring new horizons, but it also comes with inherent risks. Whether you’re trekking through remote mountains, diving into vibrant coral reefs, or navigating whitewater rapids, the potential for accidents and unexpected events is real. That’s why it’s absolutely crucial to invest in specialized insurance that’s tailored to your adventure travel plans.

Standard travel insurance often falls short when it comes to covering the unique risks associated with adventurous activities. Specialized adventure travel insurance provides comprehensive protection for a wider range of activities, including:

- Extreme sports like skiing, snowboarding, mountain biking, and rock climbing

- Water sports like scuba diving, snorkeling, and surfing

- Trekking and hiking in remote or challenging terrain

- Wildlife encounters such as safaris and expeditions

Beyond covering medical expenses, specialized adventure travel insurance can also provide protection for:

- Emergency evacuation if you’re injured or ill in a remote location

- Search and rescue operations in case you’re lost or stranded

- Loss or damage to your equipment, which can be costly to replace

- Trip cancellation or interruption due to unforeseen circumstances

Investing in specialized insurance is not just about protecting your finances; it’s about ensuring peace of mind. Knowing you’re covered in case of an emergency allows you to focus on enjoying your adventure without the worry of unexpected costs or complications. It’s a wise investment that can safeguard your well-being and prevent a potentially stressful situation from ruining your trip.

Adventure Activities Covered by Travel Insurance

Travel insurance can be a lifesaver, especially when you’re planning an adventure-filled trip. But not all policies are created equal. Before you embark on your next thrilling escapade, it’s crucial to understand which adventure activities are covered by your travel insurance.

Adventure Activities Covered by Travel Insurance can vary depending on the insurer and the specific policy. However, some common activities typically included are:

- Hiking and Trekking: Many policies cover hiking and trekking, even at high altitudes. Just be sure to check if there are any limitations on altitude or trail difficulty.

- Scuba Diving and Snorkeling: Travel insurance usually covers these activities, but it’s important to note that some policies may have restrictions on depth or specific diving certifications.

- Whitewater Rafting and Kayaking: Policies typically cover these activities, but you may need to purchase additional coverage for extreme whitewater conditions.

- Skiing and Snowboarding: Many policies cover these activities, but you might need to purchase an additional winter sports add-on for specific protection.

- Mountain Biking: Travel insurance often covers mountain biking, but it may have limitations based on the difficulty level of the trails.

It’s important to remember that some policies may have specific exclusions or limitations for adventure activities, such as:

- Extreme Sports: Activities like BASE jumping, skydiving, or bungee jumping may not be covered by standard travel insurance policies.

- Unlicensed or Unregulated Activities: Some policies may not cover activities that are not conducted by licensed or reputable operators.

To ensure that you’re adequately covered, it’s essential to:

- Read the policy carefully: Understand the coverage, exclusions, and limitations before you purchase the policy.

- Contact the insurer: Ask specific questions about the coverage for your intended adventure activities.

- Consider purchasing additional coverage: If your planned activities are not fully covered by your standard policy, you may need to purchase additional adventure sports coverage.

By carefully reviewing your travel insurance policy and making sure your planned adventures are covered, you can enjoy your thrilling escapade with peace of mind.

Factors to Consider When Choosing Adventure Travel Insurance

Adventure travel is an exhilarating experience, but it also comes with inherent risks. To ensure peace of mind and financial protection, securing the right adventure travel insurance is crucial. When choosing a policy, several factors should be considered to ensure you’re adequately covered for your thrilling escapade.

1. Activity Level and Type: Adventure travel encompasses a vast spectrum of activities, from hiking and biking to skiing and scuba diving. Therefore, it’s essential to choose insurance that specifically covers the activities you plan to engage in. Make sure the policy includes coverage for extreme sports, high-altitude activities, and any other specific risks associated with your chosen adventure.

2. Destination and Duration: Your destination and the duration of your trip will influence the insurance coverage you need. Certain regions might pose unique risks, like natural disasters or political instability. Ensure your policy covers the specific destination and duration of your adventure travel.

3. Medical Coverage: Adventure travel often involves remote locations and potential medical emergencies. Choose a policy that provides sufficient medical coverage, including evacuation costs, repatriation, and emergency medical expenses.

4. Personal Belongings Coverage: Your valuable possessions, such as cameras, electronics, and luggage, are susceptible to loss or damage during adventure travel. Ensure your insurance policy includes adequate coverage for personal belongings, including specific limits for high-value items.

5. Cancellation and Interruption Coverage: Unexpected events can disrupt your adventure travel plans. Check if your policy provides coverage for trip cancellations, interruptions, or delays due to unforeseen circumstances, such as illness, weather, or natural disasters.

6. Emergency Assistance Services: Adventure travel often involves navigating unfamiliar terrain and encountering unpredictable situations. Select a policy that offers comprehensive emergency assistance services, including 24/7 support, medical evacuation, and travel assistance.

7. Reputation and Customer Service: Research the reputation of the insurance provider and read customer reviews to ensure they have a track record of reliable service and prompt claims processing. Look for companies with strong customer service and dedicated travel assistance teams.

By carefully considering these factors, you can choose adventure travel insurance that aligns with your specific needs and provides the necessary protection for your thrilling escapades.

Top Insurance Providers for High-Risk Activities

For adrenaline junkies and thrill-seekers, finding the right travel insurance is crucial. Not all policies cover extreme sports and adventurous activities. That’s why it’s essential to research providers specializing in high-risk travel insurance. Here are some of the top insurance providers for your daring escapades:

World Nomads is a popular choice among adventurers. They offer comprehensive coverage for a wide range of activities, including skiing, snowboarding, scuba diving, and even BASE jumping. Their flexible policies and excellent customer service make them a reliable option.

SafetyWing is another excellent provider that caters to digital nomads and travelers engaging in adventurous activities. Their Nomad Insurance plan includes coverage for a variety of extreme sports, such as rock climbing, mountain biking, and surfing.

True Traveller is a UK-based provider specializing in adventure travel insurance. They offer comprehensive coverage for a wide range of high-risk activities, including trekking, mountaineering, and off-road driving.

AXA is a well-established insurance company that provides travel insurance with optional add-ons for specific activities. They offer coverage for activities like skiing, snowboarding, and scuba diving.

Allianz Global Assistance is another reputable provider that offers travel insurance plans with optional coverage for specific activities. They provide coverage for activities like skiing, snowboarding, and white-water rafting.

Before purchasing any policy, ensure you thoroughly read the terms and conditions to understand the specific activities covered and any limitations. Remember, getting the right insurance is vital to protect yourself and your finances while pursuing your adventurous dreams.

Understanding Coverage Limits and Exclusions

Before you get swept away by the thrill of adventure, it’s crucial to understand the fine print of your travel insurance policy. Coverage limits dictate the maximum amount your insurance will pay for specific situations, like medical expenses or lost luggage. For example, you might have a limit of $10,000 for medical emergencies.

Exclusions are activities or situations that your policy explicitly does not cover. These could include things like extreme sports, risky activities, or pre-existing medical conditions. Knowing these exclusions is vital, as engaging in an excluded activity could leave you without coverage in case of an incident.

Here’s a breakdown of common exclusions and how they might impact your adventure:

- Extreme Sports: If you plan on skydiving, bungee jumping, or other high-risk activities, your policy might not cover you. Check for specific clauses regarding these activities.

- Pre-Existing Conditions: If you have a pre-existing medical condition, your policy might have limitations or require additional paperwork. Make sure you’re aware of these stipulations before traveling.

- War & Terrorism: Travel insurance typically excludes coverage for events related to war or terrorism. However, some policies may offer limited protection for these situations.

It’s essential to review your policy thoroughly to understand its limits and exclusions. Consider these factors when choosing your travel insurance:

- Adventure Level: If you’re planning a high-risk adventure, look for a policy with specific coverage for extreme sports or adventure activities.

- Budget: Policies with wider coverage and higher limits usually come with a higher premium.

- Destination: Consider the potential risks of your destination when selecting coverage. For example, you might need additional medical coverage for a remote location.

By carefully reviewing your policy and understanding its limits and exclusions, you can ensure your travel insurance provides adequate protection for your thrilling escapade. Remember, knowing the fine print can help you navigate your adventure with peace of mind.

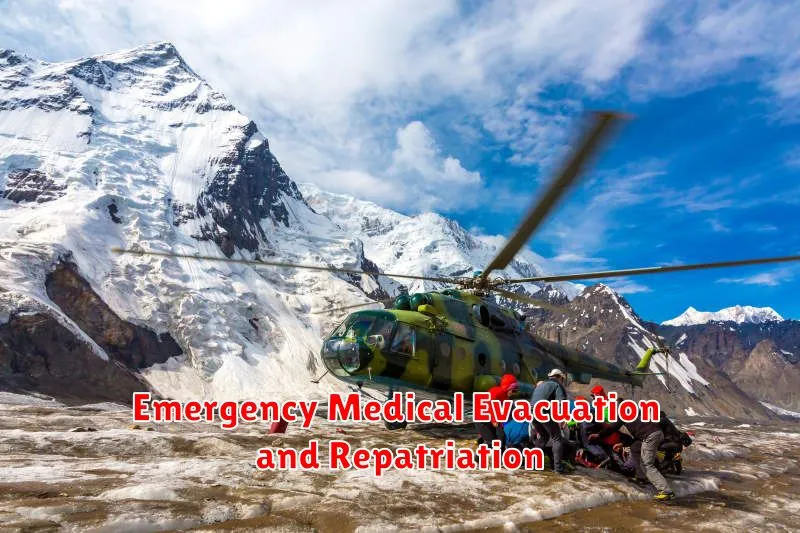

Emergency Medical Evacuation and Repatriation

When you’re embarking on an adventurous journey, the last thing you want to worry about is a medical emergency. But, the reality is that accidents can happen anywhere, and being prepared for the unexpected is crucial. Emergency medical evacuation and repatriation are crucial components of travel insurance, offering vital support in case of a medical crisis while traveling abroad.

Emergency medical evacuation refers to the transportation of a traveler from a remote location or a hospital with inadequate facilities to a medical facility equipped to handle their condition. This can be necessary for a variety of reasons, such as a severe illness, an accident, or a natural disaster. Repatriation, on the other hand, involves the transfer of a traveler’s body back to their home country if they unfortunately pass away while traveling.

These services can be incredibly expensive to arrange on your own, especially in a foreign country. That’s where travel insurance comes in. A comprehensive travel insurance plan will usually cover the costs of emergency medical evacuation and repatriation, giving you peace of mind knowing that you’ll be taken care of if a medical crisis arises.

When choosing a travel insurance policy, it’s important to carefully consider the coverage limits for these services. Some policies may have a maximum amount they will cover, so make sure you understand what is included and how much you’re protected for. Additionally, consider the geographical coverage of the policy, as some plans may have restrictions based on the destination you’re traveling to.

Having robust emergency medical evacuation and repatriation coverage in your travel insurance plan is a vital step in ensuring a safe and worry-free adventure. It provides you with the assurance that you’ll receive the necessary medical care and support in case of an emergency, allowing you to focus on your recovery and get back home safely.

Gear and Equipment Protection for Adventure Travelers

Adventure travel often involves expensive gear and equipment, from cameras and drones to hiking boots and scuba gear. Protecting your investment is crucial, and travel insurance can provide peace of mind in case of unforeseen events.

Most travel insurance plans offer gear and equipment protection, covering losses or damage due to:

- Theft: If your gear is stolen, insurance can help replace or reimburse you.

- Accidental damage: Accidents happen, and insurance can cover repairs or replacement for damaged equipment.

- Lost baggage: If your luggage containing your gear is lost, insurance can help you get it replaced.

- Natural disasters: Coverage for damage caused by natural events like floods, earthquakes, or volcanic eruptions.

When choosing a travel insurance plan, pay attention to the coverage limits and exclusions for gear and equipment protection. Some plans may have limits on the value of covered items, or specific exclusions for certain types of activities or gear.

Remember to carefully read the policy details and ensure the plan adequately covers your gear and equipment needs for your specific adventure. Consider the value of your gear and the activities you’ll be participating in to determine the appropriate level of coverage.

Travel Insurance for Solo vs. Group Adventures

Solo travel and group adventures offer different experiences and require different considerations for travel insurance. When traveling solo, you’re entirely responsible for your own safety and well-being, so comprehensive coverage is crucial. This means opting for a plan with robust medical coverage, emergency evacuation, and trip cancellation/interruption protection.

Group adventures, on the other hand, may offer some built-in safety nets. Tour operators often have liability insurance, and you might have access to a group leader for support. However, it’s still vital to have individual travel insurance for personal medical emergencies, lost luggage, or unforeseen events that may disrupt your trip.

Here’s a breakdown of key differences in insurance considerations for solo vs. group adventures:

| Feature | Solo Travel | Group Adventure |

|---|---|---|

| Medical Coverage | High-level coverage essential | Important, but may have some overlap with tour operator insurance |

| Emergency Evacuation | Crucial, especially for remote destinations | May be included in tour operator’s plan |

| Trip Cancellation/Interruption | Important for personal reasons | May be included in tour operator’s plan, but individual coverage is still recommended |

| Lost Luggage/Personal Belongings | Essential for protecting your belongings | May be included in tour operator’s plan, but check coverage limits |

Ultimately, choosing the right travel insurance for solo or group adventures depends on your individual needs and the nature of your trip. Carefully review your options and prioritize coverage that aligns with your adventure plans. Remember, having the right protection can give you peace of mind and allow you to truly conquer your next thrilling escapade!

Finding Affordable Adventure Travel Insurance Options

Adventure travel insurance can be expensive, but it’s essential for protecting yourself financially if something unexpected happens while you’re on your trip. Fortunately, there are ways to find affordable options without sacrificing coverage. Here are some tips:

1. Compare Quotes from Multiple Insurers: Don’t settle for the first quote you get. Compare quotes from several different insurers to find the best value for your money. You can use online comparison websites or work with a travel insurance broker.

2. Consider Your Trip’s Activities: The cost of your insurance will depend on the types of activities you’re planning to do. If you’re going on a high-risk adventure, you’ll likely need to pay more. However, if you’re just going on a hiking trip, you may be able to get away with a more basic policy.

3. Look for Discounts: Many insurers offer discounts for things like being a member of a travel club, paying in full, or purchasing insurance early. Ask about any potential discounts that you might qualify for.

4. Choose a Policy with the Right Coverage: Don’t be tempted by the cheapest policy if it doesn’t offer the coverage you need. Make sure your policy covers things like medical expenses, trip cancellation, and lost luggage.

5. Opt for a Higher Deductible: If you’re willing to pay a little more out of pocket in the event of a claim, you can often lower your premium by choosing a higher deductible.

6. Buy Insurance Separately: Sometimes you can save money by buying your travel insurance separately rather than through a travel agent or airline.

By following these tips, you can find affordable adventure travel insurance that will protect you and your trip without breaking the bank. Remember, it’s always better to be safe than sorry when it comes to your health and your finances!

Tips for Staying Safe While on Your Adventure Trip

Adventure travel is a thrilling experience that allows you to push your limits and explore new destinations. However, it’s important to prioritize safety and take precautions to ensure a smooth and enjoyable journey. Here are some tips to help you stay safe while on your adventure trip:

Research your destination: Before you go, research the area you’re planning to visit, including local laws, customs, and potential risks. This will help you prepare for any challenges you might encounter.

Pack appropriate gear: Pack the right gear for your adventure, including sturdy shoes, weather-appropriate clothing, and any specialized equipment required for your activity. Consider packing a first-aid kit, essential medications, and a flashlight for emergencies.

Inform others about your plans: Share your itinerary with friends or family members and let them know where you’ll be and when you expect to return. If something unexpected happens, they’ll have a better understanding of your whereabouts.

Be aware of your surroundings: Stay alert and be mindful of your surroundings, especially in unfamiliar areas. Avoid walking alone at night, and be cautious of people who seem suspicious.

Follow local safety guidelines: Pay attention to any local safety guidelines or warnings, and follow them strictly. This could include warnings about wildlife, weather conditions, or potential dangers.

Stay hydrated and eat healthy: Proper hydration and nutrition are crucial for staying healthy and energized during your adventure. Pack enough water and snacks, and prioritize nutritious meals.

Listen to your body: Don’t push yourself beyond your limits. If you feel unwell or exhausted, rest and take breaks. Avoid engaging in activities that are too challenging for your physical capabilities.

Respect the environment: Be mindful of your impact on the environment. Leave no trace behind and practice responsible travel habits.

By following these tips, you can enjoy your adventure trip while ensuring your safety and well-being. Remember, adventure travel is about exploring and challenging yourself, but it’s also important to be responsible and prioritize your safety.

Real-Life Stories: How Adventure Travel Insurance Saved the Day

Adventure travel is all about pushing boundaries, embracing the unknown, and creating unforgettable memories. But it also comes with inherent risks. That’s where adventure travel insurance comes in, offering peace of mind and financial protection for your thrilling escapades. Here are real-life stories of how adventure travel insurance saved the day:

Sarah’s Mountain Mishap: Sarah, an avid hiker, was trekking through the Himalayas when she slipped and injured her ankle. She was stranded, unable to continue. Luckily, her adventure travel insurance covered medical evacuation, transporting her to a hospital for treatment and back home for recovery.

David’s Dive Dilemma: David, a scuba enthusiast, was on a diving trip in the Maldives when he lost his expensive underwater camera. His adventure travel insurance covered the cost of replacing the camera, allowing him to continue enjoying his underwater adventures without financial stress.

Emily’s Unexpected Delay: Emily was on a climbing expedition in Patagonia when a blizzard hit, delaying her flight home. Her adventure travel insurance covered the cost of accommodation and meals during the unexpected delay, ensuring she wasn’t left stranded and out of pocket.

These are just a few examples of how adventure travel insurance can make a world of difference when things go wrong. With the right coverage, you can focus on the adventure, knowing you’re protected from unexpected events and financial burdens.