Planning your next international adventure? Don’t let currency exchange fees and hefty transaction charges derail your travel plans. A best credit card for international travel is your passport to seamless transactions and global benefits, ensuring you make the most of your trip while keeping your wallet happy. From zero foreign transaction fees to travel insurance and rewards programs, these cards offer a wealth of perks designed to enhance your travel experience.

Whether you’re jet-setting to exotic destinations or exploring bustling metropolises, choosing the right travel credit card can make all the difference. We’ve curated a list of the best credit cards for international travel, featuring cards that excel in specific areas like earning rewards, accessing airport lounges, or providing comprehensive travel insurance. Get ready to unlock a world of convenience and value with these top contenders.

Foreign Transaction Fees: What to Look Out For

Foreign transaction fees are charges that banks or credit card companies impose on transactions made outside your home country. They are often calculated as a percentage of the transaction amount, typically around 1% to 3%. These fees can add up quickly, especially if you are making several purchases while traveling abroad.

It’s crucial to consider foreign transaction fees when choosing a credit card for international travel. Look for cards that offer no foreign transaction fees, as they can significantly reduce your travel expenses. This means you’ll pay the same exchange rate as the merchant and avoid any additional fees.

Some credit cards advertise “no foreign transaction fees” but charge a markup on currency exchange rates. This effectively hides the cost of foreign transactions. Be sure to check the fine print and compare exchange rates across different cards to get the best deal.

While some cards have no foreign transaction fees, others might offer benefits like travel insurance, travel rewards, or concierge services. These features can be valuable during your trip, so it’s important to weigh the benefits against the potential fees.

Benefits of Using Credit Cards for International Purchases

Using a credit card for international purchases comes with a host of benefits that can make your travel experience smoother and more convenient. Here are some of the key advantages:

Security and Convenience: Credit cards offer a secure and convenient way to make purchases abroad. You can avoid carrying large amounts of cash, which can be risky, and enjoy the ease of making payments with a simple swipe or tap. Most credit cards also come with fraud protection, giving you peace of mind in case of unauthorized transactions.

Currency Exchange Rates: When you use a credit card for international purchases, your bank or card issuer will automatically convert the transaction from the local currency to your home currency. While there may be a foreign transaction fee, you often get a better exchange rate than you would if you were to exchange cash or use a debit card.

Travel Rewards and Perks: Many credit cards offer travel rewards programs, allowing you to earn points or miles that can be redeemed for flights, hotels, or other travel expenses. Some cards even provide access to exclusive travel benefits like airport lounge access, travel insurance, and concierge services.

Purchase Protection: Some credit cards come with purchase protection that covers you against damage or theft of items you buy with your card, providing added peace of mind during your travels.

Simplified Budgeting: Using a credit card can help you track your spending more effectively, especially when traveling. You’ll have a single statement that summarizes all your international purchases, making it easier to manage your budget and avoid overspending.

Earning Rewards on Your Global Spending

One of the biggest advantages of using a travel credit card for international trips is the potential to earn rewards on your spending. These rewards can come in various forms, including cash back, miles, or points that can be redeemed for travel expenses, merchandise, or even statement credits. The key is to choose a card that offers rewards that align with your travel goals.

For example, if you frequently fly with a specific airline, a card that offers bonus miles for purchases made on that airline could be a great fit. Alternatively, if you prioritize cash back, a card that offers a flat percentage back on all purchases might be more suitable. Some cards even provide travel insurance, airport lounge access, or other perks that can enhance your travel experience.

Remember to factor in foreign transaction fees when evaluating reward programs. Some cards waive these fees, while others charge a percentage of each transaction. It’s important to choose a card that offers the best combination of rewards, benefits, and fees to maximize your value while traveling abroad.

Travel Insurance and Protection: Stay Covered Abroad

While a robust credit card for international travel helps you manage your finances, it’s equally important to ensure you have adequate travel insurance and protection. Unforeseen events can occur while you’re abroad, from medical emergencies to flight disruptions and lost luggage. Having travel insurance provides a safety net and peace of mind, knowing you’re protected in case of unexpected situations.

Travel insurance policies vary, so it’s essential to carefully compare and select one that aligns with your specific travel needs. Consider factors such as:

- Medical coverage: This is crucial for covering medical expenses, emergency evacuation, and repatriation. Check the coverage limits and if pre-existing conditions are covered.

- Trip cancellation and interruption: This covers expenses incurred if your trip is canceled or interrupted due to unforeseen events like illness, natural disasters, or travel advisories.

- Baggage protection: This covers losses or damage to your luggage, including personal belongings.

- Travel delay coverage: This provides financial support if your trip is delayed due to weather, mechanical issues, or other factors.

- Emergency assistance: Travel insurance often includes 24/7 access to emergency assistance services for help with medical emergencies, legal issues, or other unexpected situations.

Remember, travel insurance can vary widely. Thoroughly review the policy details and coverage limitations before you commit to a specific plan. This ensures you have the right protection for your international travel plans.

Emergency Assistance and Card Replacement Services

When you’re traveling abroad, you want to be sure you’re covered in case of emergencies. Some of the best credit cards for international travel offer emergency assistance services, which can provide you with support and help you get back on your feet if you find yourself in a difficult situation. These services can include things like:

- Emergency cash advances: If your card is lost or stolen, you may be able to get a cash advance to cover your immediate expenses.

- Medical and dental referrals: If you need medical attention while you’re abroad, your credit card company may be able to provide you with referrals to local hospitals and doctors.

- Lost and stolen card replacement: If your card is lost or stolen, your credit card company can usually send you a replacement card within a few days. Some cards can even have a replacement card delivered to you at your hotel.

In addition to emergency assistance services, some credit cards also offer card replacement services. This means that if your card is lost or stolen, you can get a replacement card delivered to you at your hotel or another location of your choosing. This can be a huge time-saver if you’re trying to get back on your feet quickly after a lost or stolen card.

When you’re choosing a credit card for international travel, it’s important to compare the emergency assistance and card replacement services offered by different cards. This will help you find a card that provides the coverage you need to feel safe and secure when you’re traveling abroad.

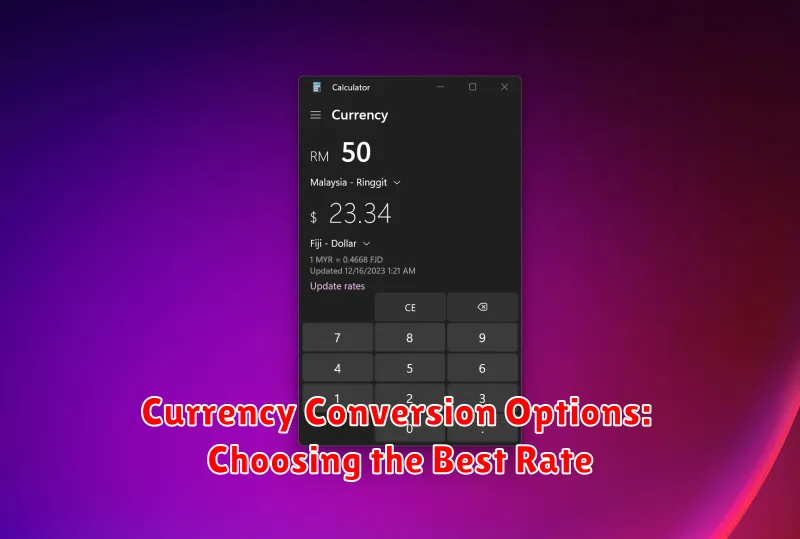

Currency Conversion Options: Choosing the Best Rate

Navigating currency conversions is a key aspect of international travel. You’ll want to find the best exchange rates to stretch your travel budget. Here are some popular options, each with their pros and cons:

Using Your Bank’s ATM: This is a convenient option, but beware! Banks often charge high fees and use unfavorable exchange rates, potentially costing you a lot.

Credit Card: Many credit cards offer foreign transaction fees, which are usually less than bank fees. Some even provide no foreign transaction fees, making them a better choice. Check your card’s specific rates and terms before traveling.

Currency Exchange Bureaus: These are widely available at airports and tourist areas. However, exchange rates can be less competitive, and they often have additional fees.

Prepaid Travel Cards: These cards are loaded with a specific amount of foreign currency. While convenient, they may have hidden fees and limited ATM withdrawal limits.

Digital Wallets and Peer-to-Peer Transfers: Platforms like Wise (formerly TransferWise) offer competitive exchange rates and transparent fees, but may take a few days for funds to be available.

Best Practices for Getting the Best Rate:

- Compare Rates: Always compare rates from different sources before committing.

- Avoid Airport Exchange Bureaus: Look for better options in the city.

- Utilize No-Fee Credit Cards: This is a wise choice for international travel.

- Research Currency Exchange Services: Platforms like Wise often provide competitive rates.

By understanding the pros and cons of each option and using smart strategies, you can maximize your travel funds by securing the best exchange rates.

Chip and PIN Technology: Enhanced Security for International Use

In today’s increasingly globalized world, traveling internationally is becoming more commonplace. As travelers venture across borders, they need convenient and secure payment methods. Chip and PIN technology has emerged as a robust solution for international transactions, enhancing security and reducing the risk of fraud.

Chip and PIN technology utilizes a microchip embedded in the credit card, which stores encrypted data. When making a purchase, the card is inserted into a terminal, the chip communicates with the terminal, and the cardholder is prompted to enter their Personal Identification Number (PIN). This two-factor authentication process adds an extra layer of protection compared to traditional magnetic stripe cards, which are susceptible to skimming and cloning.

For international travelers, chip and PIN cards offer several benefits:

- Enhanced Security: The chip and PIN system significantly reduces the risk of fraudulent transactions, offering greater peace of mind.

- Global Acceptance: Chip and PIN cards are widely accepted in many countries around the world, making them a convenient option for international purchases.

- Increased Convenience: The use of PINs eliminates the need for signatures, streamlining the payment process.

As a traveler, selecting a credit card equipped with chip and PIN technology is a smart choice. It provides an extra layer of security and ensures seamless transactions while exploring the globe.

Mobile Payment Solutions for Travelers

As a traveler, navigating unfamiliar currencies and payment systems can be daunting. Thankfully, mobile payment solutions offer a seamless and secure way to make transactions abroad. Services like Apple Pay, Google Pay, and Samsung Pay allow you to link your credit or debit cards to your smartphone, enabling convenient contactless payments at various merchants worldwide. These platforms often offer enhanced security features, such as tokenization, which replaces your actual card details with a unique digital identifier. This safeguards your sensitive financial information and provides an extra layer of protection against fraud.

Beyond traditional payment methods, mobile wallets like PayPal and Venmo are gaining popularity among travelers. These services enable peer-to-peer payments, making it easy to split costs with travel companions or receive money from friends and family back home. Some mobile wallets also offer currency exchange features, allowing you to convert your funds into local currency at competitive rates. This can save you money on foreign exchange fees compared to traditional methods.

Furthermore, mobile payment apps often integrate with travel-related services, enhancing the overall travel experience. For instance, Uber and Lyft accept mobile payments, simplifying transportation arrangements. Some mobile wallets even offer travel insurance or rewards programs, providing additional benefits to travelers. By embracing mobile payment solutions, you can streamline your financial transactions, enhance security, and enjoy a more hassle-free travel experience.

Top Credit Cards with No Foreign Transaction Fees

When traveling abroad, one of the biggest expenses you’ll face is the foreign transaction fee. These fees, typically a percentage of the purchase amount, can quickly add up and eat into your travel budget. To avoid these hidden costs, consider using a credit card that waives foreign transaction fees.

Here are some top credit cards that offer this valuable perk:

- Chase Sapphire Preferred® Card: This card boasts no foreign transaction fees, along with a generous sign-up bonus, travel and dining rewards, and travel insurance benefits.

- Capital One Venture X Rewards Credit Card: Offering no foreign transaction fees, this card also provides valuable travel perks like priority airport lounge access and travel insurance, making it ideal for international travelers.

- Citi Premier® Card: This card offers no foreign transaction fees, a generous points earning structure, and valuable travel benefits like travel insurance and airport lounge access.

Choosing a credit card with no foreign transaction fees can save you money on international travel expenses. Remember to carefully review the terms and conditions of each card before applying, as fees and benefits may vary.

Best Cards for Travel Rewards and Perks

With the right credit card, you can enjoy travel benefits that make your international trips more convenient and rewarding. From earning valuable points for flights and hotels to accessing airport lounges and enjoying travel insurance, these cards can enhance your overall travel experience.

Here are some of the best credit cards for travel rewards and perks:

Chase Sapphire Preferred® Card: This popular card earns 2x points on travel and dining, making it a great option for frequent travelers. It also offers a generous sign-up bonus, access to the Chase Ultimate Rewards portal for redeeming points, and travel insurance benefits.

Capital One Venture X Rewards Credit Card: This card earns 2 miles per dollar on all purchases, including travel, and offers a valuable sign-up bonus. It comes with travel insurance benefits and access to Priority Pass lounges.

The Platinum Card® from American Express: This premium card offers a wide range of benefits, including a high annual fee. It provides access to Centurion Lounges, travel insurance, and airline credits. The card also earns rewards on travel and other categories.

Citi Prestige® Card: This card comes with a generous sign-up bonus and earns 3x points on airfare, hotels, and restaurants. It also offers access to airport lounges, travel insurance, and other perks.

United Quest℠ Card: If you’re a frequent flyer with United Airlines, this card is a great option. It offers bonus miles on United flights and other travel expenses. You’ll also receive free checked bags, priority boarding, and other benefits.

Tips for Using Credit Cards Responsibly While Traveling Abroad

When using credit cards abroad, it’s crucial to be mindful and responsible to avoid any potential pitfalls. Here are some essential tips to keep in mind:

Notify Your Bank: Before you leave, inform your bank or credit card issuer about your travel dates and destinations. This will prevent your card from being declined due to unusual activity. You can typically do this online or through a phone call.

Understand Foreign Transaction Fees: Credit cards often charge a foreign transaction fee (typically 1-3%) for transactions made in a currency different from your home currency. Look for cards that waive these fees or have low foreign transaction fees to save money.

Choose the Right Card: Different cards offer different benefits for travel. Look for cards that provide travel insurance, rewards points, or airport lounge access. Remember, the best card for you depends on your individual needs and spending habits.

Monitor Your Account: Regularly check your credit card statements for any suspicious activity. Be vigilant about unauthorized charges and report them to your bank immediately.

Use ATMs Wisely: When using ATMs abroad, choose machines operated by major banks and opt for the local currency instead of your home currency. This usually leads to better exchange rates.

Keep Receipts: It’s always wise to keep all receipts from transactions made with your credit card, especially for big purchases. This can help you track your spending and resolve any potential disputes.

By following these simple tips, you can ensure a smoother and more financially responsible travel experience abroad.