Embarking on a long-term adventure is an exciting prospect, full of the promise of new experiences and unforgettable memories. But with extended travel comes the added responsibility of ensuring your well-being and financial security. This is where travel insurance plays a crucial role. A comprehensive travel insurance plan can provide peace of mind, knowing that you’re protected against unforeseen circumstances and potential risks.

Choosing the right travel insurance for your long-term adventure can seem daunting, with a myriad of options and varying coverage. This ultimate guide will walk you through the essential factors to consider, from coverage types to budgeting tips, empowering you to make an informed decision and enjoy your trip without worry.

Understanding Long-Term Travel Insurance

Long-term travel insurance is specifically designed for those embarking on journeys lasting more than 90 days. It provides coverage for a wider range of situations and often offers more comprehensive benefits compared to standard travel insurance policies. This type of insurance is essential for anyone planning extended trips, as it protects you financially in case of unexpected events.

Here are some key aspects of long-term travel insurance to consider:

- Extended Coverage: Long-term travel insurance typically covers a broader spectrum of events, including medical emergencies, evacuation, baggage loss, trip interruption, and even cancellations.

- Pre-Existing Conditions: Many policies offer coverage for pre-existing medical conditions, which is particularly important for those with chronic illnesses or past injuries.

- Higher Coverage Limits: These policies often come with higher coverage limits for medical expenses and other benefits.

- Flexibility: Some policies allow you to extend your coverage or even adjust your plan as your travel itinerary changes.

Understanding long-term travel insurance helps you choose the right policy to protect your financial wellbeing during your extended adventure. When selecting a plan, ensure it covers the specific needs of your journey and your personal circumstances.

Why You Need Travel Insurance for Extended Trips

Extended trips offer the opportunity for adventure and exploration, but they also come with a higher risk of unforeseen circumstances. This is where travel insurance plays a vital role, providing a safety net for your journey. Travel insurance for extended trips goes beyond covering basic medical expenses and flight delays; it safeguards you from a wide range of potential issues that could arise during your long-term adventure.

One of the most compelling reasons to secure travel insurance is to protect yourself from medical emergencies. In unfamiliar destinations, the cost of medical care can be astronomical. Travel insurance can cover the expense of hospitalization, surgery, and evacuation, preventing you from facing financial ruin in the event of a health crisis.

Another significant benefit of travel insurance is its coverage for trip cancellation or interruption. Unexpected events, such as illness, family emergencies, or natural disasters, can disrupt your travel plans. Travel insurance reimburses you for non-refundable expenses, ensuring you don’t lose a substantial amount of money if your trip is cut short or canceled.

For extended trips, lost or stolen luggage can be a major inconvenience. Travel insurance provides coverage for the replacement or repair of your belongings, allowing you to focus on enjoying your travels without worrying about financial losses.

Travel insurance also offers peace of mind by providing emergency assistance services. If you find yourself in a difficult situation, such as a travel delay or a personal emergency, travel insurance providers can help you with everything from finding accommodation to coordinating medical assistance.

In conclusion, investing in travel insurance for extended trips is a wise decision that provides comprehensive protection and peace of mind. It ensures you have a safety net in place to handle unforeseen circumstances, allowing you to focus on enjoying your adventure without the burden of financial stress.

Factors to Consider When Choosing Long-Term Travel Insurance

Choosing the right travel insurance for a long-term adventure is crucial for ensuring your peace of mind and financial protection. Here are some key factors to consider when making your decision:

Duration of Coverage

Long-term travel insurance policies typically offer coverage for periods exceeding 30 days. Ensure the policy you choose covers the entire duration of your trip. It’s also important to consider the possibility of extending your trip and whether the policy allows for easy extensions.

Coverage for Specific Activities

If you plan to engage in adventurous activities like skiing, scuba diving, or trekking, make sure your policy covers those activities. Standard policies may have limitations or require additional coverage for certain sports and hobbies.

Medical Coverage

Medical emergencies can be costly, especially abroad. Look for a policy with adequate medical coverage, including emergency medical evacuation, hospitalization, and medical expenses. Consider the maximum coverage limit and the deductibles applicable to medical claims.

Baggage and Personal Belongings

Your policy should provide coverage for lost, stolen, or damaged luggage and personal belongings. Check the maximum coverage amount and any limitations on specific items, such as electronics or jewelry.

Pre-Existing Conditions

If you have pre-existing medical conditions, ensure the insurance company will cover them. Some policies may have exclusions or require additional pre-existing conditions coverage.

Customer Service and Claims Process

Research the insurer’s reputation for customer service and the ease of filing claims. Look for a company with a streamlined and responsive claims process.

Cost and Value

Compare the cost of different policies while considering the value they provide. Look for comprehensive coverage at a reasonable price. Keep in mind that a more expensive policy may offer more extensive coverage and benefits.

By carefully considering these factors, you can select the best long-term travel insurance to protect yourself during your extended adventure.

Coverage Options for Long-Term Travelers

Long-term travel insurance is designed for those who plan to be away from home for an extended period, typically more than 30 days. It offers comprehensive coverage to protect you against various risks that you might encounter during your travels. Here are some key coverage options that are crucial for long-term travelers:

Medical Coverage

Medical expenses can be astronomical, especially in foreign countries. Long-term travel insurance provides coverage for emergency medical treatment, hospital stays, and medical evacuation. Look for plans that offer high medical expense limits and include coverage for pre-existing conditions if you have any.

Trip Cancellation and Interruption

Unexpected events can force you to cancel or interrupt your trip. Long-term travel insurance offers financial protection for such scenarios. This coverage helps you recover costs associated with non-refundable travel expenses, such as flights, accommodations, and tours.

Evacuation and Repatriation

In case of an emergency, you may need to be evacuated from your destination. Long-term travel insurance can cover the costs of medical evacuation, repatriation of remains, and emergency travel for a family member to join you.

Baggage and Personal Effects

Your belongings are vulnerable to theft, damage, or loss while traveling. Long-term travel insurance provides coverage for your luggage and personal effects. This coverage helps you replace or repair stolen or damaged items, ensuring peace of mind.

Adventure Sports and Activities

If you plan to engage in adventurous activities like scuba diving, skiing, or trekking, ensure your travel insurance covers these activities. Some policies offer specific coverage for adventure sports, while others may have limitations.

Liability Coverage

In the event of an accident or incident that causes harm to others, long-term travel insurance provides liability coverage. This protection covers legal fees and damages resulting from accidental injury or property damage caused by you.

When selecting long-term travel insurance, carefully consider the specific coverage options offered by different providers. Assess your travel itinerary, personal needs, and budget to choose a plan that provides comprehensive protection for your long-term adventure.

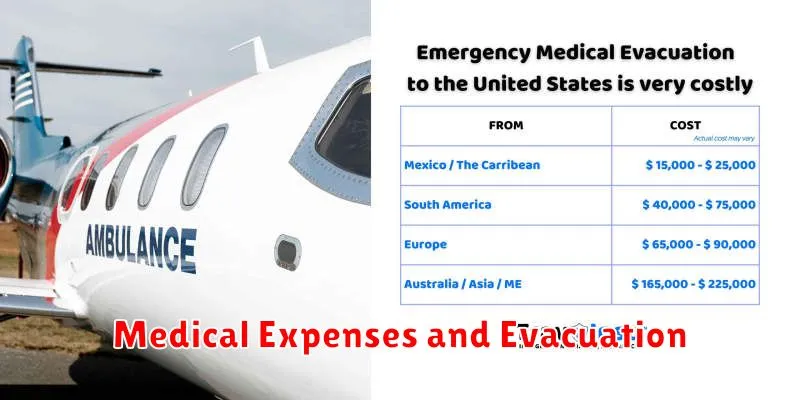

Medical Expenses and Evacuation

When traveling, especially for extended periods, medical emergencies can arise unexpectedly. Medical expenses and evacuation are significant concerns, and travel insurance can provide crucial protection in such situations.

A robust travel insurance plan should cover medical expenses, including hospital stays, surgeries, medications, and doctor consultations. It should also provide medical evacuation, which covers the cost of transporting you back home or to a suitable medical facility if necessary.

Consider the following when choosing travel insurance for medical expenses and evacuation:

- Coverage amount: Ensure the policy covers sufficient medical expenses and evacuation costs, especially for long-term travel.

- Geographic coverage: Verify if the policy covers the countries you will be visiting.

- Pre-existing conditions: Check if the policy covers pre-existing health issues.

- Emergency medical services: Explore the insurance company’s network of providers and emergency medical services.

Thoroughly review the policy terms and conditions to understand the specific coverage and limitations. Remember that comprehensive travel insurance, including robust medical and evacuation coverage, is a vital investment for long-term adventures, providing peace of mind and financial security.

Trip Cancellation and Interruption

For long-term adventures, trip cancellation and interruption coverage is crucial. It protects you from financial losses if you have to cancel or cut short your journey due to unforeseen circumstances. These circumstances can include:

- Illness or injury: If you or a traveling companion becomes ill or injured before or during the trip, you can be reimbursed for non-refundable trip expenses.

- Family emergencies: Covering situations like a death in the family or the need to care for a sick child.

- Natural disasters: In case of a natural disaster at your destination, forcing you to cancel or cut short your trip, insurance will provide coverage.

- Job loss: Some policies may even cover job loss, allowing you to claim back your pre-paid expenses if you’re forced to cancel due to losing your job.

When choosing a policy, make sure to carefully review the coverage details and exclusions. Pay attention to the maximum coverage amount for cancellation and interruption, as well as the specific events that are covered. Also, understand the waiting period for filing a claim. It’s essential to understand how these details affect your potential reimbursement and ensure the coverage aligns with your adventure’s specifics.

Baggage Loss and Delay

Losing your luggage during a long-term adventure can be a nightmare, especially if it contains essential items. Travel insurance can provide financial protection in such situations. Look for policies that offer coverage for baggage loss and delay, and pay attention to the following details:

- Coverage Limits: Understand the maximum amount your insurer will pay for lost or delayed luggage.

- Deductibles: You’ll likely have to pay a deductible before your insurance kicks in.

- Exclusions: Check for specific items that are not covered, such as valuables or fragile items.

- Claims Process: Familiarize yourself with the process for filing a claim in case of baggage loss or delay.

Some travel insurance policies also offer replacement costs for essential items, allowing you to purchase new necessities while you wait for your lost luggage. Additionally, they may provide compensation for delays, covering expenses like meals and accommodation.

Personal Liability Coverage

While it’s unlikely, it’s always possible to accidentally hurt someone or damage someone’s property while traveling. This is where personal liability coverage comes in handy. This portion of your travel insurance policy protects you financially if you are held liable for injuries or damages caused to others.

Imagine this: You’re trekking through a foreign country and accidentally bump into someone, causing them to fall and break their leg. With personal liability coverage, your insurance will cover the costs associated with their medical bills, lost wages, and other damages.

Why is it important? It’s crucial to consider this coverage for long-term adventures because you’ll be in unfamiliar environments and may engage in activities with higher risk. It can offer peace of mind, knowing you’re protected from potential financial burdens.

When choosing travel insurance, be sure to check the limits of personal liability coverage offered. You’ll want to ensure it’s sufficient for the type of activities you plan to engage in. Some policies may have exclusions or limits on certain activities, so read the fine print carefully.

Remember, it’s always best to be cautious and responsible while traveling. But having personal liability coverage as part of your travel insurance provides an extra layer of protection for you and your finances.

Adventure Sports and Activities Coverage

If you plan to engage in any adventure sports or activities during your long-term travels, it’s crucial to ensure your travel insurance policy offers adequate coverage. Many standard policies exclude or have limitations for high-risk activities like rock climbing, scuba diving, skydiving, and skiing.

To avoid any unpleasant surprises, carefully review your insurance policy and look for specific coverage for the following:

- Adventure sports activities: Make sure your policy clearly states the specific adventure activities it covers.

- Medical expenses: Accidents can happen, so ensure the policy covers medical costs related to adventure sports injuries.

- Emergency evacuation: In case of a serious accident, having coverage for emergency evacuation is vital.

- Equipment coverage: If you’re carrying expensive equipment, check if your policy includes coverage for its loss or damage.

- Liability coverage: This is essential in case you cause damage to property or injure someone while participating in adventure activities.

It’s wise to contact your insurance provider directly to discuss your planned adventure sports activities and confirm coverage details. Be transparent about your plans to ensure they meet your specific needs. Don’t hesitate to ask about additional options or add-ons that might enhance your coverage for adventure activities.

Pre-Existing Medical Conditions

When choosing travel insurance for long-term adventures, pre-existing medical conditions are a crucial factor to consider. Most standard travel insurance policies won’t cover pre-existing conditions, leaving you financially vulnerable in case of an emergency. Therefore, you’ll need to look for a specific plan that offers coverage for your specific condition.

Here’s what you need to know:

- Disclosure is Key: Be completely transparent about your pre-existing conditions when applying for travel insurance. Failing to disclose can result in your claim being denied.

- Seek Specialized Plans: Look for travel insurance plans specifically designed for pre-existing conditions. These policies usually have higher premiums but offer the necessary protection.

- Waiting Periods: Some policies have waiting periods before they cover your pre-existing conditions. This means you may need to purchase the policy well in advance of your trip.

- Limited Coverage: Coverage for pre-existing conditions might be limited. Check the policy details to understand what’s covered and what’s excluded.

- Consult with a Broker: A travel insurance broker can help you find the right plan that caters to your specific needs and pre-existing conditions.

Remember, navigating pre-existing conditions and travel insurance can be complex. Doing your research and seeking expert guidance will ensure you have adequate protection for your long-term adventure.

Working or Studying Abroad Considerations

If you’re planning to work or study abroad, travel insurance is essential. These programs often require specific insurance coverage and having the right plan can provide peace of mind.

Work visas typically require proof of health insurance. Your travel insurance should cover medical expenses, including emergency evacuation, should you require it.

Study abroad programs also often have insurance requirements. Check with your program provider for specific guidelines. Your travel insurance should include coverage for academic disruptions due to illness or injury, as well as potential liability for damages.

Consider the duration of your stay. Long-term travel insurance policies are designed for extended trips, offering more comprehensive coverage and potentially lower premiums.

Think about your activities. If you’re planning on engaging in risky activities like adventure sports, make sure your insurance policy includes coverage for those activities.

Research different providers and compare policies. Look for features like 24/7 emergency assistance, international coverage, and reliable claims processing.

Invest in a comprehensive plan that covers all aspects of your long-term adventure, including medical expenses, travel disruptions, and liability. A solid travel insurance policy can provide invaluable peace of mind, allowing you to focus on your studies or work abroad without worry.

Digital Nomad and Remote Work Coverage

As a digital nomad or remote worker, you’re often on the move, which means you need travel insurance that goes beyond the typical vacation coverage. You need a policy that understands the unique challenges and risks you face, such as working from different locations, having valuable equipment, and potentially needing medical care in unfamiliar places.

Look for insurance policies that offer specific coverage for remote workers and digital nomads. This might include:

- Equipment coverage: This is crucial for protecting your laptop, phone, and other essential gear from theft, damage, or loss.

- Business interruption coverage: If an unexpected event prevents you from working, this coverage can help you recoup lost income.

- Medical evacuation and repatriation: If you require emergency medical attention, these benefits can cover the cost of transportation and medical expenses, even in remote locations.

- Extended trip duration options: Many standard travel insurance policies only cover trips up to a certain length. Make sure your policy covers your entire planned journey.

It’s also important to consider coverage for liability, which can protect you if you accidentally cause damage or injury to others while traveling.

Before purchasing any policy, carefully read the terms and conditions to ensure the coverage meets your specific needs. You should also consider contacting a specialist travel insurance broker who can provide personalized advice and recommendations.

Comparing Insurance Providers

When it comes to comparing insurance providers, it’s vital to focus on what truly matters for your long-term adventure. Don’t just look at the cheapest option; consider the coverage, exclusions, and reputation of each provider.

Here’s a breakdown of key aspects to compare:

- Coverage: What activities are covered? Are pre-existing conditions included? What are the limits on medical expenses, baggage loss, and emergency evacuation?

- Exclusions: What activities or situations are not covered? This can be crucial for adventurous travelers.

- Reputation: Check online reviews and forums to see how other travelers have experienced the provider’s claims process.

- Customer Service: How accessible are they? Are they responsive and helpful?

- Price: While price is important, don’t let it be the only factor. Compare quotes from multiple providers and consider the overall value proposition.

Consider using a travel insurance comparison website to streamline the process. They often allow you to input your trip details and preferences, providing tailored quotes from multiple insurers.

Remember, choosing the right travel insurance provider can make the difference between a carefree adventure and a stressful situation. Invest the time to compare options carefully and choose the provider that best meets your individual needs and budget.

Tips for Saving Money on Long-Term Travel Insurance

Long-term travel insurance can be expensive, but there are ways to save money without sacrificing coverage. Here are a few tips:

Compare quotes from multiple insurers. Don’t just go with the first insurer you find. Get quotes from several different companies to compare prices and coverage. You can use a comparison website like InsureMyTrip or Squaremouth to make this process easier.

Consider a higher deductible. A higher deductible will mean a lower premium. If you’re willing to pay more out of pocket in the event of a claim, you can save on your insurance costs.

Look for discounts. Some insurers offer discounts for things like being a member of certain organizations, traveling with a group, or paying your premium in full. Be sure to ask about any discounts that may be available to you.

Buy your insurance in advance. Buying your insurance in advance can often save you money. Insurers may offer discounts for early purchase, and you’ll be less likely to need to buy insurance at the last minute, which can be more expensive.

Travel during the off-season. Traveling during the off-season can often save you money on flights, accommodation, and activities. It can also lead to lower insurance premiums, as there are often fewer claims made during these times.

Only purchase the coverage you need. If you’re a young and healthy traveler, you may not need as much coverage as an older traveler with pre-existing conditions. Avoid buying unnecessary coverage, as this can lead to higher premiums.

Consider travel insurance alternatives. There are some alternatives to traditional travel insurance, such as travel credit cards with built-in travel insurance benefits, or travel insurance plans offered by certain banks or credit unions. Be sure to compare the benefits and limitations of these alternatives before making a decision.